Money Owed To Me In North Carolina

Property Finder Information NCCASH

Any person, acting individually or on behalf of a business entity, that charges a fee to locate unclaimed property for another, must register annually with the North Carolina Department of State Treasurer and follow all requirements of General Statute . Beginning January 1, 2022, property finders must also be licensed with the North Carolina Private Protective Services Board as a private investigator – General Statute Please see below a listin...

https://www.nccash.gov/property-finder-information

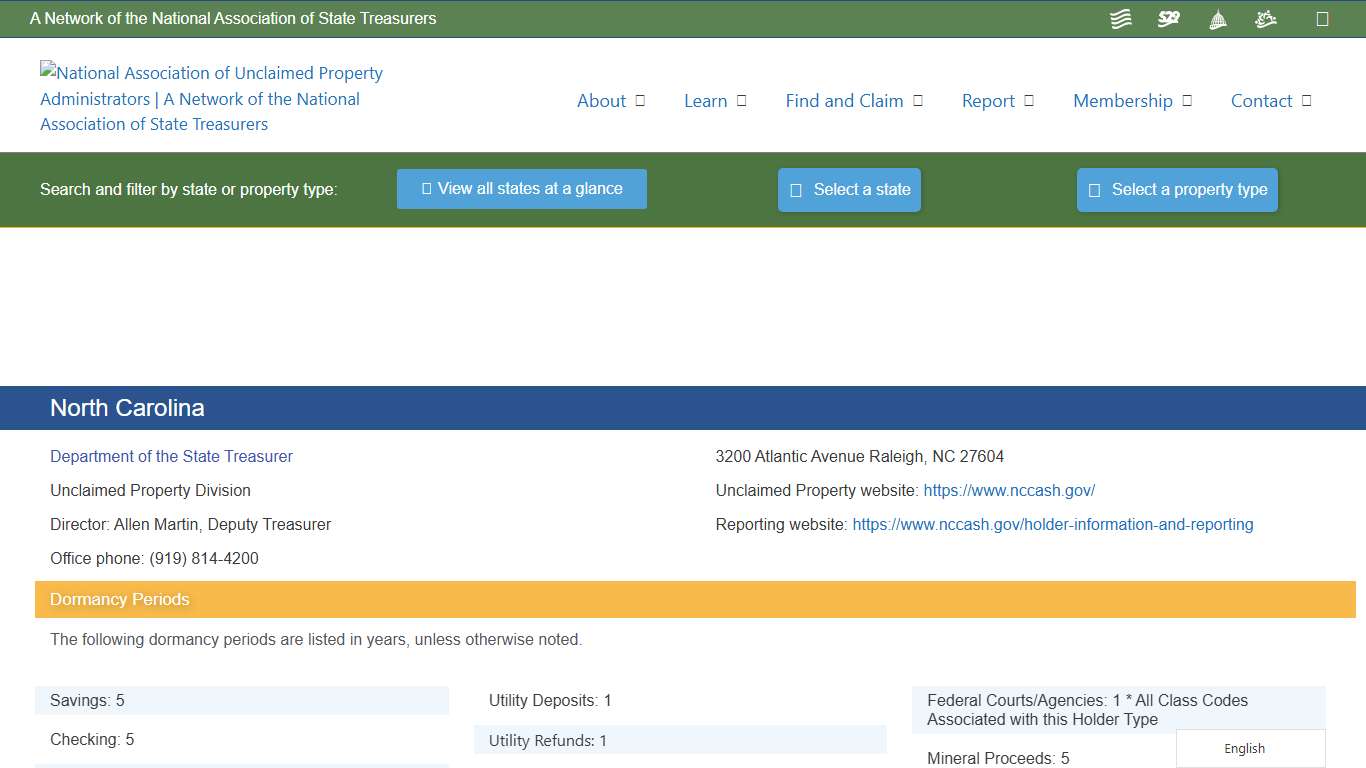

North Carolina – National Association of Unclaimed Property Administrators (NAUPA)

Dormancy Periods The following dormancy periods are listed in years, unless otherwise noted. Reporting and Payment Due Dates The following indicates the report and payment due dates for the various property types. Electronic Reporting Capability Schedule The following indicates which types of reporting formats are accepted by this state.

https://unclaimed.org/reporting/north-carolina-2/

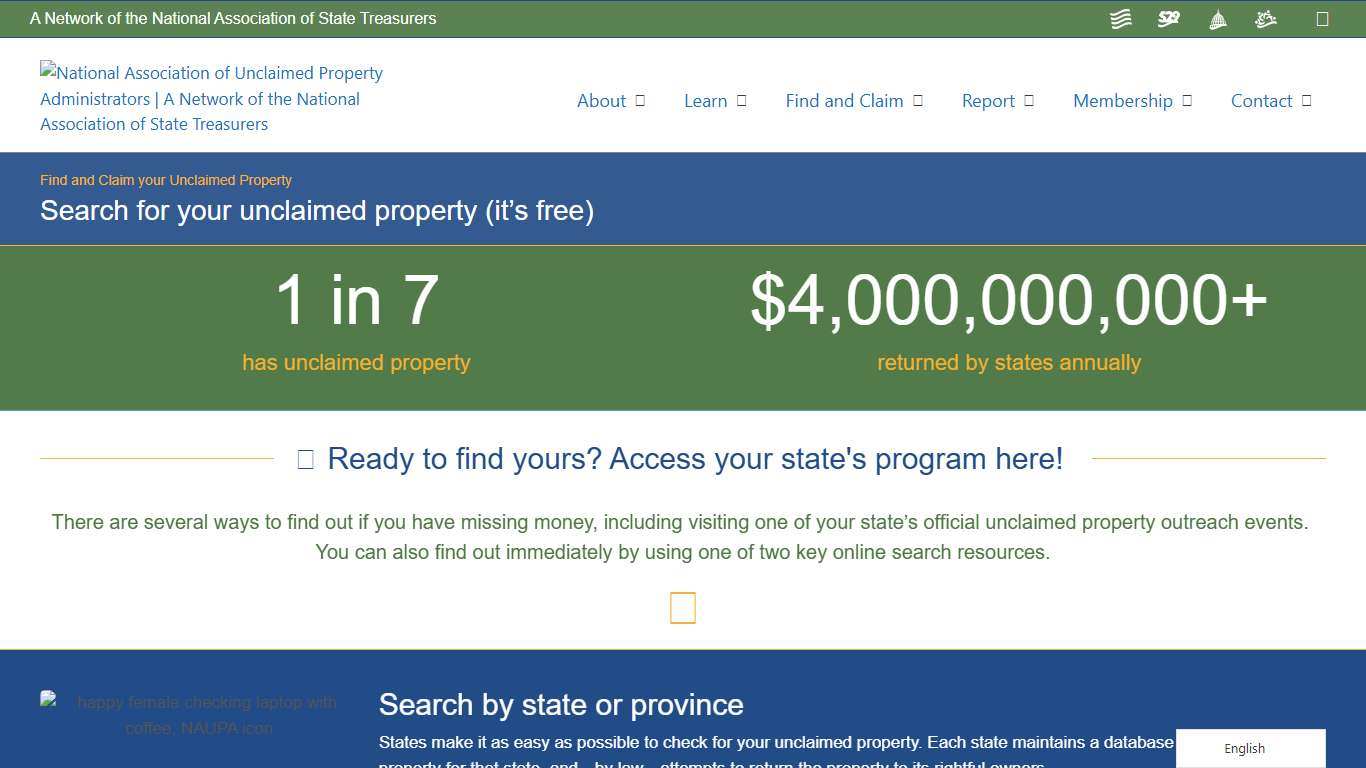

National Association of Unclaimed Property Administrators (NAUPA) – The leading, trusted authority in unclaimed property

NAUPA is the leading, trusted authority in unclaimed property. We help individuals claim their unclaimed property, and help businesses ensure compliance per state law in annual reporting. Search for property in your state or province Use the interactive map below or select from the list to find the official unclaimed property program for a state or province.

https://unclaimed.org/

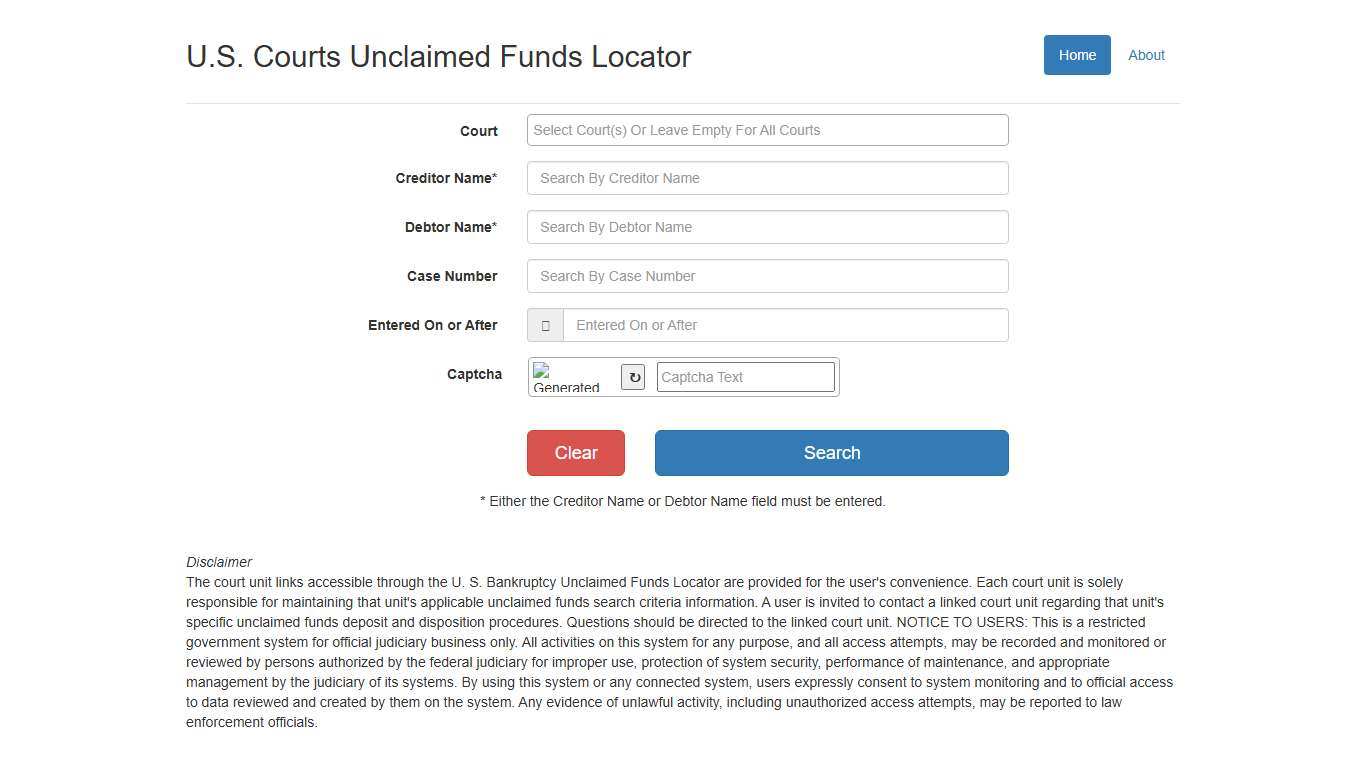

Unclaimed Funds Locator

* Either the Creditor Name or Debtor Name field must be entered.

https://ucf.uscourts.gov/

Over $1 billion is owed to NC residents in unclaimed money

North Carolina might owe you money. In some cases, North Carolina might owe you a ... www.citizen-times.com. All rights reserved.

https://www.citizen-times.com/story/news/local/2023/10/16/1-billion-in-nc-unclaimed-funds-heres-how-to-claim-your-money/71168028007/Delinquent Taxpayer Lists Office of the Tax Collector

Top 100 Delinquent Taxpayer List. This monthly list reflects the tax record as of. Jan. 5, 2026. Any change in status; such as amount paid ...

https://tax.mecknc.gov/services/Delinquent-Taxpayer-ListsSearch for your unclaimed property (it’s free) – National Association of Unclaimed Property Administrators (NAUPA)

Ready to find yours? Access your state's program here! There are several ways to find out if you have missing money, including visiting one of your state’s official unclaimed property outreach events. You can also find out immediately by using one of two key online search resources.

https://unclaimed.org/search/

Home nc.gov

The Latest Governor Stein and Emergency Management Officials Provide Updates as Winter Storm Impacts North Carolina “North Carolina: we are not out of the woods yet. Freezing rain today and bitter cold in the coming days will continue to bring dangerous road conditions and power outages,” said Governor Josh Stein.

https://www.nc.gov/

What happens to any remaining proceeds after a foreclosure sale, and who is entitled to claim them? nc - Pierce Law Group Estate Administration Lawyers North Carolina

What happens to any remaining proceeds after a foreclosure sale, and who is entitled to claim them? – North Carolina Short Answer In North Carolina, foreclosure sale money gets paid out in a set order (sale costs, certain taxes/assessments, then the mortgage debt).

https://piercelaw.com/news/partition-action-qa-series/what-happens-to-any-remaining-proceeds-after-a-foreclosure-sale-and-who-is-entitled-to-claim-them-nc/

Article - 309.1 - Procedure for Recon...

Title University of North Carolina at Chapel Hill Finance Procedure 309.1 - Procedure for Reconciling, Reporting, and Escheating Abandoned Property Introduction Purpose To maintain appropriate fiscal reporting and ensure internal controls are met to prevent fraud, all unclaimed property, primarily in the form of uncashed checks issued from university checking accounts to include payroll checks, accounts payable checks, and departmental imprest...

https://policies.unc.edu/TDClient/2833/Portal/KB/ArticleDet?ID=131507

Home nc.gov

The Latest Governor Stein and Emergency Management Officials Provide Updates as Winter Storm Impacts North Carolina “North Carolina: we are not out of the woods yet. Freezing rain today and bitter cold in the coming days will continue to bring dangerous road conditions and power outages,” said Governor Josh Stein.

https://www.nc.gov/

Tax Administration - Bladen County, NC

NOTICE TO BLADEN COUNTY TAXPAYERS The 2025 property taxes on real estate and personal property are now delinquent. Interest and enforced collection on all delinquent taxes has begun as of Tuesday, January 6, 2026. 2026 LISTING NOTICE: For 2026, ALL who own or control personal property, business property, made improvements to real property, or receive a HOMESTEAD EXCLUSION, must list all such property beginning: JANUARY 2, 2026, thru JANUARY 31...

https://bladennc.govoffice3.com/?SEC=5CFD4559-C3AD-41AA-98B2-A8848651E76A

Consumer: Protect Your Property if a Judgment is Entered against You Welcome to LawHelpNC.org A guide to free and low cost legal aid, assistance and services in North Carolina

If a judgment for money owed has been entered against you, the creditor with the judgment can attempt to use your property to pay or enforce the judgment. To protect your property from being used to pay the judgment, the following steps must be followed: - The creditor with a judgment must give you notice of your right to protect your property.

https://www.lawhelpnc.org/resource/protect-your-property-if-a-judgment-is-entere

Durham County Foreclosure

Foreclosure About Foreclosure The Durham County Tax Collector, at the direction of the Durham County Commissioners and the Durham City Council, is aggressively pursuing the collection of delinquent real and personal property taxes. Click to view the Delinquent Taxpayer List. One of the collection tools used by the Tax Collector is the employment of private attorneys to commence formal foreclosure proceedings under North Carolina General Statut...

https://dconc.gov/Tax-Administration/Payment-Options-and-Collections/Foreclosure

Surprise Checks Coming: State Treasurer Curtis Loftis announces "Palmetto Payback" initiative to return $600,000 in Unclaimed Funds to South Carolinians - SC Office of the State Treasurer

Surprise Checks Coming: State Treasurer Curtis Loftis announces "Palmetto Payback" initiative to return $600,000 in Unclaimed Funds to South Carolinians May 5, 2025 COLUMBIA, SC (May 5, 2025) – Some South Carolinians may find some unexpected cash in their mailboxes this month, thanks to a new initiative from State Treasurer Curtis Loftis.

https://treasurer.sc.gov/about-us/newsroom/surprise-checks-coming-state-treasurer-curtis-loftis-announces-palmetto-payback-initiative/

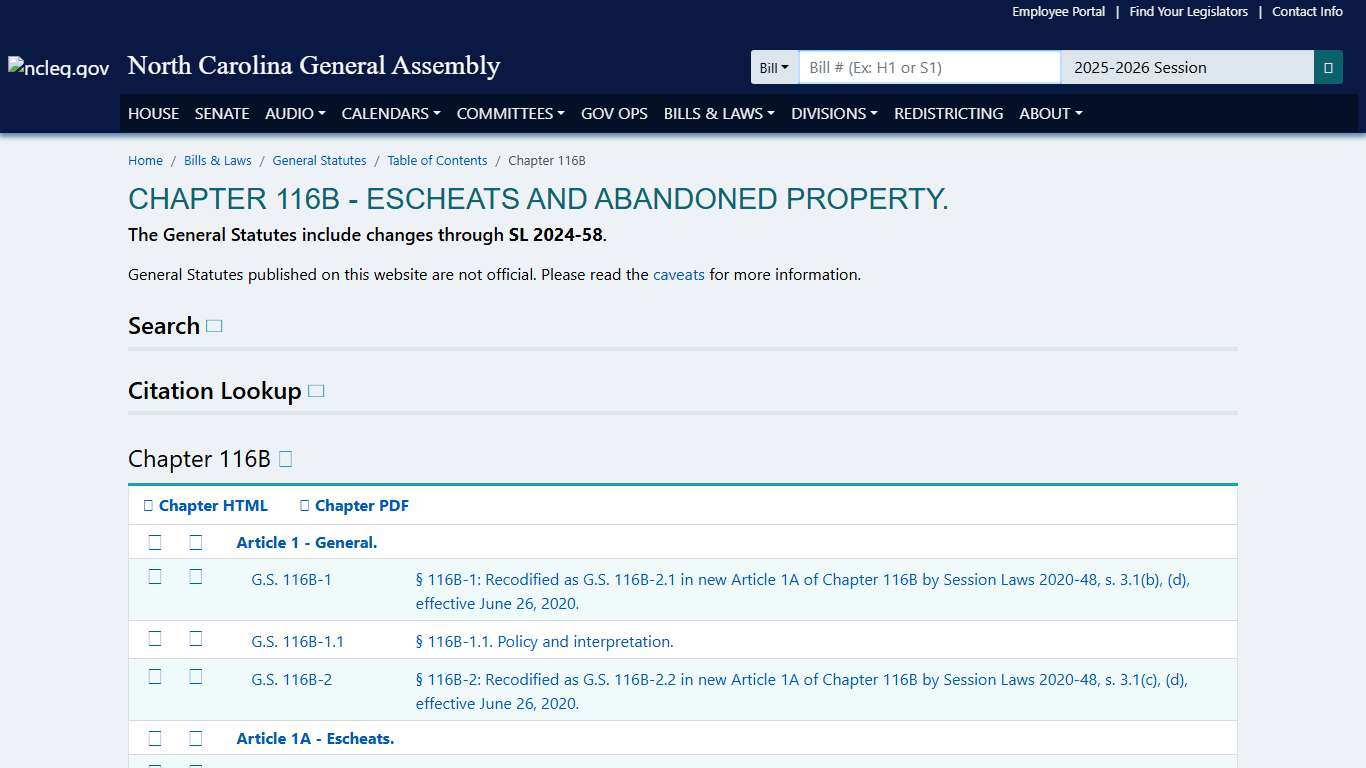

General Statute Sections - North Carolina General Assembly

Chapter 116B - Escheats and Abandoned Property. The General Statutes include changes through SL 2024-58. General Statutes published on this website are not official. Please read the caveats for more information. Search Citation Lookup Chapter 116B General Statutes published on this website are not official. Please read the caveats for more information.

https://www.ncleg.gov/Laws/GeneralStatuteSections/Chapter116B

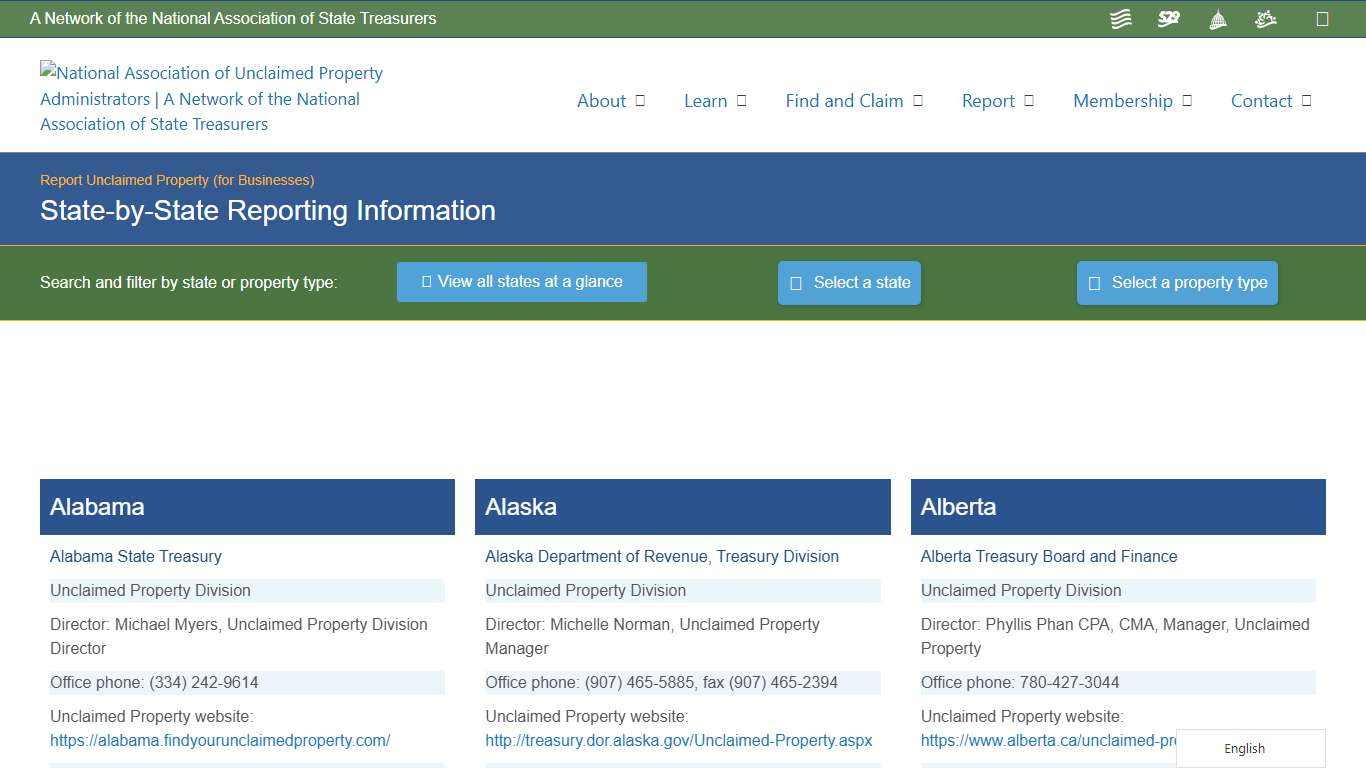

State-by-State Reporting Information – National Association of Unclaimed Property Administrators (NAUPA)

North Carolina. Department of the State Treasurer. Unclaimed Property ... Copyright 2026 · National Association of Unclaimed Property Administrators ...

https://unclaimed.org/state-reporting/

Hospital Payment Program and Medical Debt Relief Initiative Approved for Another Year NCDHHS

The North Carolina Department of Health and Human Services received approval from the Centers of Medicare and Medicaid Services to continue the Healthcare Access and Stabilization Program (HASP) that makes hospital incentives for the state’s medical debt relief initiative possible. The first two years were approved in July 2024.

https://www.ncdhhs.gov/news/press-releases/2025/02/05/hospital-payment-program-and-medical-debt-relief-initiative-approved-another-year

NCSBI - Misuse of State Property

Misuse of State Property State agencies are required by law to report to the N.C. State Bureau of Investigation when money or property is missing or is stolen to the Professional Standards Division. North Carolina law requires state employees who are informed of or have evidence of misuse of state property by a state employee to report that information within three days to the reporting employee's immediate supervisor.

https://www.ncsbi.gov/Divisions/Misuse-of-State-Property

Eastern District of North Carolina United States Bankruptcy Court

Court Locations Hours: 8:30 a.m. through 4:30 p.m. weekdays, excluding holidays (No new case will be accepted at the Court Clerk's front counter after 4:00 p.m.) Please call 919-856-4752 to receive instructions on alternative means of filing and making payment. U.S.

https://www.nceb.uscourts.gov/